Sometimes there are issues that come up when a startup has a bad VC representative on the startup’s corporate board. This can result in an overly restrictive corporate covenant that will allow investors to veto significant corporate decisions and actions. This can result in a startup’s leadership management becoming fractured and cause a number of issues that can cause serious long term repercussions such as a toxic work environment. Sometimes this is so problematic that a company will be unable to innovate, adapt to changing market conditions or continue to grow.

With such a small number of investments to make, VCs tend to be very selective in the type of deals they do, typically placing just a few bets each year. Tom Thunstrom is a staff writer at Fit Small Business, specializing in Small Business Finance. He holds a Bachelor’s degree from the University of Minnesota and has over fifteen years of experience working with small businesses through his career at three community banks on the US East Coast. In a prior life, Tom worked as a consultant with the Small Business Development Center at the University of Delaware. VC firms are very easy to locate because they are documented in business directories.

Thus, it will be cheaper route of exit as compared to the public offer. We know that sourcing money for our startups can be both an exhilarating and stressful experience, and venture capital investment is no different. The primary disadvantage of VC is that entrepreneurs give up an ownership stake in their business. Many a time, it may so happen that a company requires additional funding that is higher than the initial estimates.

Crowdfunding – where multiple people fund your company, creating a larger pool of finance. Doing so may see them receive equity in your business, though alternative incentives exist. Expect to have an engaging marketing campaign if you want to attract funders. The nature of venture capital means you must give away company shares. They will need to see your business plan, financial forecasts, and other relevant supporting documents as part of their due diligence. You must provide these and ensure your enterprise’s value is evident – which means inputting time and effort into creating sufficient documentation to win funding.

Sources of Finance: Sale of Assets | JD Sports Sells 15 Brands to Competitor

Venture capital in the UK originated in the late 18th century, when entrepreneurs found wealthy individuals to back their projects on an ad hoc basis. This informal method of financing became an industry in the late 1970s and early 1980s when a number of venture capital firms were founded. There are now over 100 active venture capital firms in the UK, which provide several billion pounds each year to unquoted companies mostly located in the UK. It is easy to consume yourself with the process of applying for venture capital funding.

Rather than just going like month-to-month, paycheck-to-paycheck, or whatever you want to call it. You’re not going to be relying on certain customers to come through on the account receivables, to make sense. You’re just going to go out there with whatever money you have, and you’re going to go and execute on the roadmap that you have presented to your investors. When funding your company or startup with venture capital, you will transfer a portion of control to the investor.

Therefore, if you do need support for a high-risk idea, venture capitalist investment might be for you. It will allow you to turn your idea into a real business that generates profits for you and your VC. Venture capitalist firms have become increasingly popular in the past years. For example, you may have seen various LinkedIn posts by founders sharing their latest funding press release on Tech Crunch. Before we dive into the pros and cons of venture capitalists, first let’s define what a venture capitalist is. › The primary disadvantage of using angel investors is the loss of complete control as a part-owner.

VC investors are likely to demand a large share of company equity, and they may start making demands of the company’s management as well. Many VCs are only seeking to make a fast, high-return payoff and may pressure the company for a quick exit. The goal of a venture capital investment is a very high return for the venture capital firm, usually in the form of an acquisition of the startup or an IPO. Venture capital is financing that’s invested in startups and small businesses that are usually high risk, but also have the potential for exponential growth. Mezzanine firms – provide loan finance that is halfway between equity and secured debt.

It not only provide the financial institution but also assist in management, technical and others. The terms of the agreement entitle the investor to receive interest and principal payments. In addition, the company pays the common investor interest and repays the principal amount of the loan when it matures. › The four major types of capital advantage and disadvantage of venture capital include working capital, debt, equity, and trading capital. The capital acquired at this stage acts like a seed that grows into an abundant tree for new enterprises. Taking the time to research VC firms and find one best suited to your needs will reduce the chance of complications and enable you to get a deal that you’re satisfied with.

Help Raising Future Rounds of Funding Is Available

It’s also expensive with a number of accounting and legal costs involved that go into the preparation. One of the things about the top-tier venture capital firms is that they have platforms. They have platforms where they literally plant those platforms into your business and help you to speed things up in a way that you didn’t know was there.

If you are looking for long-term support, VCs will enable you to grow and optimise your operations to ensure extended success. If you have high growth potential and struggle to raise finance elsewhere, it may be worth considering VC instead. This also works if your start-up idea could be deemed high-risk. Start-up and early stage finance for risky businesses showing high potential for growth. Small investments from lots of people in return for equity shares in your business. Venture capital funding can offer large amount of equity financing to the company.

There are many advantages of venture capitalist funding, from the money you get to the network opportunities it offers. They want their portfolio companies to be able to generate sales and profits before competitors enter the market and reduce profitability. The fewer direct competitors operating in the space, the better.

- Has a diverse background in development, asset management, property management, construction management, and underwriting.

- Venture Capital Firms are mostly run by a number of partners, who have managed to pool in a considerable source of finance, based on which the group can invest on behalf of these companies.

- This process might include analyzing financial statements, interviewing customers and suppliers, and meeting with the management team.

- Potential is no guarantee of success, and a huge payoff is not the favored outcome, statistically speaking.

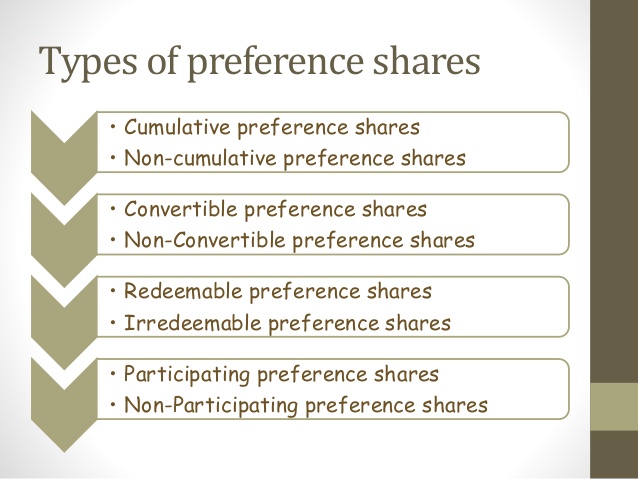

In such situations, the owners may end up losing their majority stake in the company, and with that, the power to make decisions. #TypeDefinition1Seed fundingAs the same suggests, seed funding or seed capital is the capital invested to help entrepreneur conduct initial activities for setting up a company. This can include product research & development, market research, business, business plan creation, etc. Venture debt financing is a type of loan given to startups and other early-stage companies that offers more flexibility than other forms of capital, but often at higher cost. A venture capital-backed IPO refers to selling to the public shares in a company that has previously been funded primarily by private investors. Companies seek equity financing from investors to finance short or long-term needs by selling an ownership stake in the form of shares.

Offered to commercialise ideas –Those opting for VC usually seek investment to commercialise their idea of a product or a service. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace.

Now, we don’t want that to put you off at all, but it is essential to highlight how hard it is to get approved. This is one of the biggest challenges when raising a funding round. Pre-Seed-stage is capital provided to an entrepreneur to help them develop an idea. It helps new products with modern technology become commercially feasible. It promotes export oriented units to earn more foreign exchange.

May require high Return on Original Investment

In this article, we’ll talk you through the pros and cons of venture capitalists and whether the investment is really worth the hype. On receiving a proposal of interest, a venture capital firm usually follows up with a thorough investigation of the company’s investment potential. This process might include analyzing financial statements, interviewing customers and suppliers, and meeting with the management team. If the venture capital firm remains interested following the evaluation phase, it usually responds with a proposal of its own, known as a term sheet.

For example, two startups both need $1 million and are valued at $10 million. The first company takes out a Small Business Administration loan for 10 years at 10% interest, the other raises $1 million for 10% equity. With all that’s been said so far, expectations can be through the roof. The focus is primarily on fast scaling and growth, and some VCs pose limited time to earn capital gains.

Why Is Venture Capital Important?

One that doesn’t mean turning off all of the customers you’ve gained. If speed is important, and it usually is, then raising VC money can be for you. If you don’t like what you see, or if a particular pattern keeps emerging, then it might be best to look elsewhere, particularly if you have a precise vision for your company. Except in the business world, things are rarely so straightforward. Even if you manage to pitch successfully, you’re not home and dry; while it may be tempting to take the first six-figure cheque that comes your way, there are certain things that you first need to consider. Annie Sisk is a freelance writer who lives in upstate New York.

Major Disadvantages of Venture Capital

Therefore, they may pressurize the company owner to list the company. This untimely listing of the company could result in the undervaluation of the company’s shares. Venture capitalists have a huge network of connections in the business community. These connections could be advantageous for the start-ups to grow and become successful. They can help the start-up enter into alliances with potential customers or business houses.

Your angel investor will have a say in how the business is run and will also receive a portion of the profits when the business is sold. Dream Unlimited Corporation is a Canadian real estate development firm. The firm intends to provide ESG focused debt capital to US markets. First, the company approaches potential investors, such as banks, or financial institutions, to secure debt financing. Furthermore, the investor evaluates creditworthiness, financial stability, and loan repayment ability. Debt financing is usually provided in the form of loans, bonds, or other types of debt securities.

The most obvious benefit is that venture capital provides you with significant additional resources. This additional capital will enable your company to cover the purchase of various assets and other startup costs all at once, effectively accelerating the growth of your company. It is an excellent alternative to venture capital funding as it has competitive interest rates and repayment terms of ~10 years. So as long as they have the cash flow to repay the loan, it could be a good option.